Financial Losses Due to Lost or Stolen Mobile Devices

Posted by: Timothy Weaver on 08/26/2016 11:40 AM

[

Comments

]

Comments

]

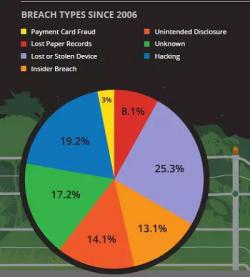

The news is full of reports of losses due to phishing scams or ransomware, but the leading cause of financial losses is actually due to lost or stolen mobile devices.

The report did not go into details such as how the devices were lost or stolen, but does acknowledge that any loss can be dire for the financial institution.

“This gets at what constitutes a breach - even if a device were lost due to an employee's carelessness, the organization must still disclose that event because there is some chance that the data may fall into the wrong hands. Given the volume of sensitive data accessed by employees on a daily basis, it's inevitable that some will find its way onto devices and that some devices will be lost or stolen,” said Salim Hafid, Bitglass product manager.

And the numbers are rising. In 2013, the financial sector saw 37 data breaches. 2014 the number jumped to 45. The amount of data breaches in the finance industry almost double in 2015 to 87. And in the first half of 2016, 5 of the top 20 banks have seen a data breach.

Source: SCMagazine

The report did not go into details such as how the devices were lost or stolen, but does acknowledge that any loss can be dire for the financial institution.

“This gets at what constitutes a breach - even if a device were lost due to an employee's carelessness, the organization must still disclose that event because there is some chance that the data may fall into the wrong hands. Given the volume of sensitive data accessed by employees on a daily basis, it's inevitable that some will find its way onto devices and that some devices will be lost or stolen,” said Salim Hafid, Bitglass product manager.

And the numbers are rising. In 2013, the financial sector saw 37 data breaches. 2014 the number jumped to 45. The amount of data breaches in the finance industry almost double in 2015 to 87. And in the first half of 2016, 5 of the top 20 banks have seen a data breach.

Source: SCMagazine

Comments