IDC lowers its forecast for tablet shipments in 2013

Posted by: Timothy Tibbetts on 08/29/2013 10:01 AM

[

Comments

]

Comments

]

I have long maintained that PC sales are down because people have numerous devices including tablets and smartphones so obviously you need to replace your PC less often. Factor in the fact that a tablet can be expensive and has its limitations and I always assumed that the tablet market had to slow down.

You also can consider, at this time, that Apple and Samsung have new tablets coming and that can cause people to pause. Windows tablets have seen price drops and the Kindle and Nook want your attention as well. There isn’t enough market for all these devices and the average Joe isn’t going to own 5 devices and change his or her mind every 6 months. Period. You also have kids who have gone back to school ending that rush and Christmas only 4 month away.

Here is their thoughts and now you see why we don't like to post a lot of news that falls under rumor or even worse, analysts.

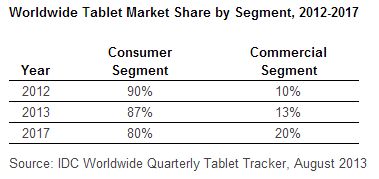

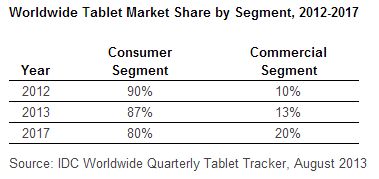

"Faced with growing competition from larger smartphones and the prospect of new categories such as wearable devices diverting consumer spending, International Data Corporation (IDC) Worldwide Quarterly Tablet Tracker modestly lowered its tablet forecast for 2013 and beyond. The company now expects worldwide tablet shipments to reach 227.4 million units in 2013, down from a previous forecast of 229.3 million but still 57.7% above 2012 shipments. Despite the slight reduction for this year, the market will continue to grow at a rapid pace and by 2017 IDC expects worldwide shipments to be nearly 407 million units. The company also adjusted its regional outlook, with maturing markets such as the U.S. now expected to cede share more rapidly to emerging markets such as Asia/Pacific.

"A lower than anticipated second quarter, hampered by a lack of major product announcements, means the second half of the year now becomes even more critical for a tablet market that has traditionally seen its highest shipment volume occur during the holiday season," said Tom Mainelli, Research Director, Tablets. "We expect average selling prices to continue to compress as more mainstream vendors utilize low-cost components to better compete with the whitebox tablet vendors that continue to enjoy widespread traction in the market despite typically offering lower-quality products and poorer customer experiences."

Thanks, Captain Obvious!

You also can consider, at this time, that Apple and Samsung have new tablets coming and that can cause people to pause. Windows tablets have seen price drops and the Kindle and Nook want your attention as well. There isn’t enough market for all these devices and the average Joe isn’t going to own 5 devices and change his or her mind every 6 months. Period. You also have kids who have gone back to school ending that rush and Christmas only 4 month away.

Here is their thoughts and now you see why we don't like to post a lot of news that falls under rumor or even worse, analysts.

"Faced with growing competition from larger smartphones and the prospect of new categories such as wearable devices diverting consumer spending, International Data Corporation (IDC) Worldwide Quarterly Tablet Tracker modestly lowered its tablet forecast for 2013 and beyond. The company now expects worldwide tablet shipments to reach 227.4 million units in 2013, down from a previous forecast of 229.3 million but still 57.7% above 2012 shipments. Despite the slight reduction for this year, the market will continue to grow at a rapid pace and by 2017 IDC expects worldwide shipments to be nearly 407 million units. The company also adjusted its regional outlook, with maturing markets such as the U.S. now expected to cede share more rapidly to emerging markets such as Asia/Pacific.

"A lower than anticipated second quarter, hampered by a lack of major product announcements, means the second half of the year now becomes even more critical for a tablet market that has traditionally seen its highest shipment volume occur during the holiday season," said Tom Mainelli, Research Director, Tablets. "We expect average selling prices to continue to compress as more mainstream vendors utilize low-cost components to better compete with the whitebox tablet vendors that continue to enjoy widespread traction in the market despite typically offering lower-quality products and poorer customer experiences."

Thanks, Captain Obvious!

Comments